how much tax on death

Estate and gift taxes the congressional budget office noted raised only about 14 billion in federal revenue in. Yes Estate tax exemption level.

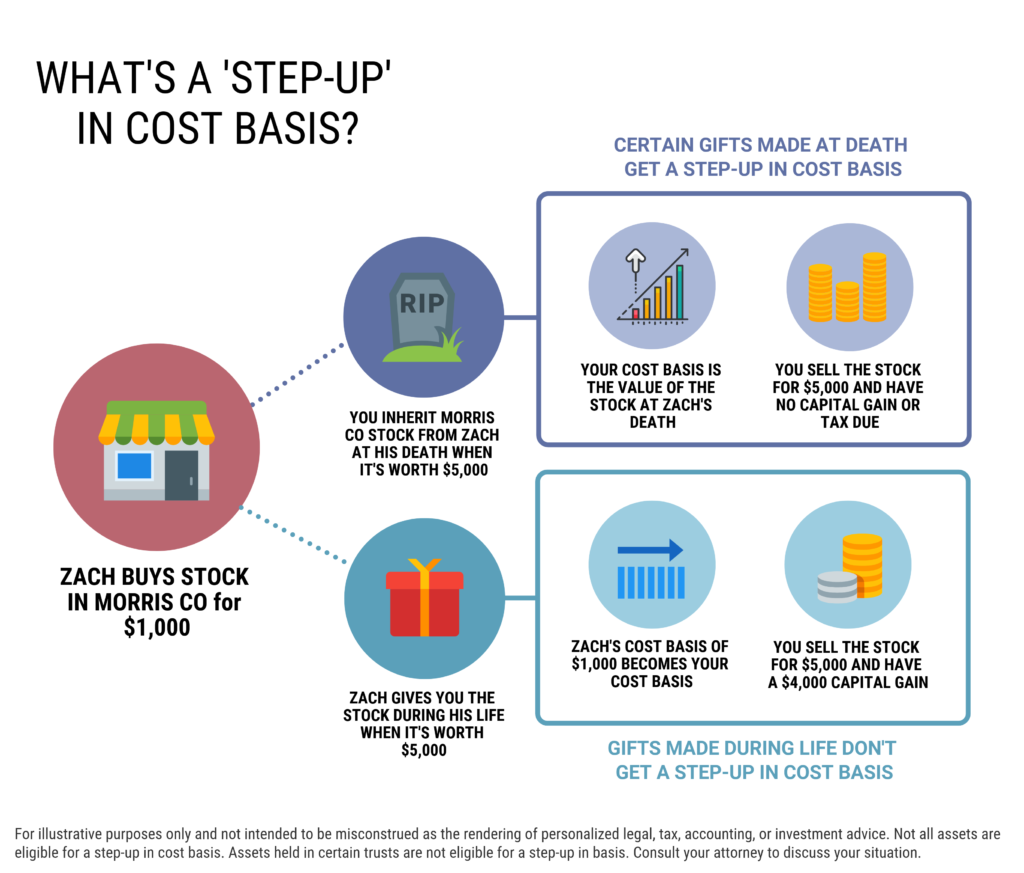

What Is A Step Up In Basis Cost Basis Of Inherited Assets

After subtracting any exemptions the total value of the taxable estate will be left.

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

. Federal exemption for deaths on or after January 1. No Inheritance tax rates. Paying tax on income received by the estate of someone who has died.

The Estate Tax is a tax on your right to transfer property at your death. For more information on this estate tax go to 145. Interest accrues on the funds during the delay and that interest is taxable when the funds are eventually paid out.

Although there is no death tax in Canada there are two main types of tax that are collected after someone dies. If you take those distributions before you reach the age of 595 youll likely have to pay a 10 early withdrawal penalty fee to the IRS. However tax may be due on any interest earned by the death benefit.

Depending upon the type of plan and whether the participant died before or after retirement payments had started the. Up to 1158 million can pass to heirs without any federal estate tax although exemption amounts on state estate taxes in certain states are considerably lower and can apply even when the federal. An investor who bought Best Buy BBY in 1990 would have a gain.

First there are taxes on income or on capital gains earned during the last year of life. The federal estate tax sometimes called the death tax is a one-time tax that is imposed at death. For married couples the exemption rises to 25 million of appreciation.

Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average. 31 2017 and Jan. Upon your death all the assets in your estate are added together to determine the value of your overall estate.

For decedents dying in 2021 the federal estate tax exemption is 117 million and increasing to 1206 million in 2022 due to changes stemming from the Tax Cut and Jobs Act TCJA so this much of every estate can pass tax-free. All the assets of a deceased person that are worth 1170 million or more as of 2021 are subject to federal estate taxes. Its only charged on the part of your estate thats above the threshold.

The Federal government charges an estate tax that. Example Your estate is worth 500000 and your tax-free threshold is. Usually this type of income doesnt have tax deducted before its received.

Most people end up not paying the death tax as it applies to only a few people. That amount increases to 1206 million for the 2022 tax year. 71 million Estate tax rates.

Under Bidens AFP the untaxed gains on investments held at death like a stock a residence or real estate would likely be taxed at a top rate of 396 above an exemption of 1 million per individual plus 250000 more for a residence. In just about all cases the death benefits paid by insurance policies are free from income tax. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

Any income received after the persons death such as rent from a property or income from the persons business belongs to their estate. The IRS offers an exemption on the first 549 million of the estate as of 2017. Its unlikely youll need to worry about the federal estate tax.

Individual Tax Return Form 1040 Instructions. Youll have to pay taxes on any distributions taken out of the account at current income tax rates. Tax-wise the new IRA recipient is subject to the same tax rules that any IRA holder would be.

The plan will likely request a copy of the death certificate. The decedents income will count from January 1 of the year they passed until the day before they passed. The federal tax reform law that passed in December 2017 doubled the estate tax exemption amount from 5 million to 10 million indexed for inflation to 1158 million for 2020.

Currently estates under 114 million are exempt but this reverts back to. 108 - 12 Inheritance tax. Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

It will sunset in 2025 unless Congress chooses to renew it. For the 2021 tax year the federal estate tax exemption was 1170 million and In the 2022 tax year its 1206 million. For this type of income the executor of the.

Write deceased next to the taxpayers name when filling out tax forms. This tax is progressive and is based on the total value of the deceaseds estate. Instructions for Form 1040 Form W-9.

This situation occurs when the payout of death benefits is delayed. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. For instance the 2018 federal tax law applies the estate tax to any amount above 10 million 8 which when indexed.

The standard Inheritance Tax rate is 40. But the increase made by the Tax Cuts and Jobs Act is temporary applying only to tax years between Dec. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF.

So unless you think youll have more than five. When a person dies the tax deadline is automatically extended to April 15 tax day of. While estate taxes seem to get all the publicity when it comes to taxes owed after someone dies the reality is that the majority of estates will not owe any federal estate taxes.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Death In The Family Turbotax Tax Tips Videos

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

State Studies On Monetary Costs Death Penalty Information Center

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Is Inheritance Tax Payable When You Die In Singapore Singaporelegaladvice Com

A Simple Guide To What Tax Is Payable On Super Death Benefits

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How Could We Reform The Estate Tax Tax Policy Center

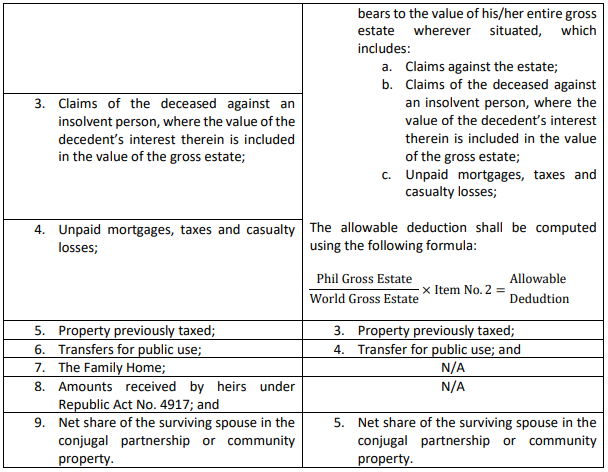

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

What Reliefs And Exemptions Are There From Inheritance Tax Low Incomes Tax Reform Group

What Happens To Property Owned Jointly By The Deceased And Someone Else Low Incomes Tax Reform Group

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-6a117470967b4b49960be0fb69f474a4.jpg)